SINGAPORE Credit is the world’s largest market, with more than $300 trillion in motion. It has underwritten households, corporations and empires, shaping outcomes more than any other asset class. Yet it still runs on outdated rails that are slow, opaque and constrained. The world is ready for something different.

And what better time? Right now, everything from clothes to Ubers to gig tickets is financed. Nearly sixty percent of Coachella tickets were bought with Buy Now Pay Later. Even DoorDash now runs on credit. People scale their lives instantly through borrowed capital, without waiting. And yet in crypto’s most speculative market, credit barely exists. IMF.BZ was built to fill that gap – and is thriving in an unchallenged market…

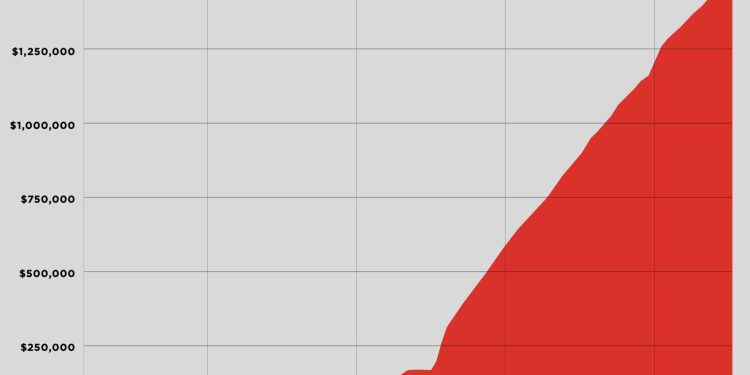

In just nine weeks the IMF protocol hit nine figures. It has paid out over a million dollars in yield while generating six figures in profit. Most crypto projects burn capital. IMF produces it.

The model is simple. IMF hijacked DeFi’s tools, and repurposed them for memecoins. For the first time users can deposit a meme, borrow against it, and unlock liquidity without selling. Traders can act before others enter the game. Credit means speed, leverage and power.

The other side is the token that governs it. Holding the token $IMF puts you in the Credit Cartel. Token holders decide which projects get listed, how much they receive and who is excluded. With enough tokens you can take over the entire operation, legally. The protocol, the treasury, the brand, the IP, the revenue (est $1.38m annually) – the lot. $IMF is not another token. It is the keys to the machine.

But there’s also a bigger picture to play for. This is about re-platforming the most powerful market in existence. Credit is coming onchain. Open access, programmable instruments and provable integrity will reshape capital. Even partial migration unlocks trillions. A full migration redefines capitalism itself.

IMF positions capital for that inevitability. It is a network of associates allocating with discretion, laying the rails for onchain credit while others chase speculation.

The momentum for IMF is only beginning. What started as nine figures in nine weeks has the potential to scale into billions as the project finds more support and more markets. As more capital flows through IMF, the protocol strengthens, the Cartel gains influence, and the market edges closer to systemic change. Each listing, each loan, and each yield cycle compounds the rise.

For centuries belief was the foundation of credit. (The Latin root of credit is the word ‘credere’; to trust and to believe). Onchain, belief is no longer fragile. It is truth, recorded and verifiable. Evidence. The IMF Credit Cartel is not here to join the game. It’s here to own it.